Get ready for retirement with an IRA

Enjoy structured savings and investment opportunities for the future.

Benefits You'll Love

- Fund your account via rollover or direct contribution

- Traditional and Roth options available

- Tax-advantaged savings options

- Prepare for retirement ahead of time

- Tax-advantaged retirement savings1

- Competitive interest above standard savings rates

- Traditional and Roth IRA options

- No setup fees

- No monthly or annual maintenance fees

- Annual contribution limits apply (see current contribution limits; $7000 as of 2024)

- Additional $1,000 "catch-up" contribution allowed for ages 50+

- Funds can be used to purchase CDs within IRA

There are advantages to both traditional and Roth IRAs. One of the biggest differences is the time at which you see the most advantage. A traditional IRA provides potential tax relief today, while a Roth IRA has the potential for the most tax benefit at time of retirement.

Traditional IRA

- No income limits to open

- No minimum contribution requirement

- Contributions are tax deductible on state and federal income tax2

- Earnings are tax deferred until withdrawal (when usually in lower tax bracket)

- Withdrawals can begin at age 59½

- Early withdrawals subject to penalty3

- Mandatory withdrawals at age 72

Roth IRA

- Income limits to be eligible to open Roth IRA1

- Contributions are NOT tax deductible

- Earnings are 100% tax free at withdrawal2

- Principal contributions can be withdrawn without penalty2

- Withdrawals on interest can begin at age 59½

- Early withdrawals on interest subject to penalty3

- No mandatory distribution age

- No age limit on making contributions as long as you have earned income

1Consult a tax advisor.

2Subject to some minimal conditions. Consult a tax advisor.

3Certain exceptions apply, such as healthcare, purchasing first home, etc.

Use this calculator to determine your projected earnings from our Kasasa Cash account. Move the sliders or type in the numbers to see your potential rewards.

- Estimated Annual Rewards $0

- Estimated monthly dividends earned* $0

- Monthly ATM fees refunded**$0

This calculator compares the costs of buying or leasing a vehicle. There are three sections to complete, and you can adjust and experiment with different scenarios.

- Net cost of buying $0

- Net cost of leasing $0

A fixed-rate, fixed-term CD can earn higher returns than a standard savings account. Use this calculator to get an estimate of your earnings. Move the sliders or type in numbers to get started.

- Total value at maturity $0

- Total dividends earned $0

- Annual Percentage Yield (APY)0.000%

Whether it's a down payment, college, a dream vacation...a savings plan can help you reach your goal. Use the sliders to experiment based on length of time and amount per month.

- Monthly deposit needed to reach goal $0

This calculator can help you get a general idea of monthly payments to expect for a simple loan. Move the sliders or type in numbers to get started.

- Estimated monthly payment $0

- Total paid $0

- Total interest paid $0

Auto & Motorcycle Loans

| Loan Type | 36 Month APR | 60 Month APR | 72 Month APR |

|---|---|---|---|

| New (2026 - 2025) | 5.24% | 5.49% | 5.74% |

| Used (2026 - 2022) | 5.49% | 5.74% | 5.99% |

| Used (2021 - 2020) | 6.04% | 6.04% | 7.24% |

| Used (2019 and older) | 7.09% | 7.64% | N/A |

Collateral subject to approval. Rates based on creditworthiness.

For motorcycles, add 1.00% to the base auto loan rate.

Payment Example: New auto loan of $20,000 for 60 months at 5.24% APR will have a monthly payment of $380.

Payment Example: New auto loan of $30,000 for 72 months at 5.49% APR will have a monthly payment of $490

Cash Secured Loans

| Loan Type | APR |

|---|---|

| Savings Secured Loan | 3.30% above pledged shares |

| Certificate (CD) Secured Loan | 2.30% above pledged certificate |

CD/Share Certificates

| Term | Minimum Balance | Dividend Rate | APY |

|---|---|---|---|

| 6 Month 12 Month 15 Month 18 Month 24 Month 36 Month 48 Month 60 Month |

$1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 |

3.69% 3.69% 3.69% 3.45% 3.54% 3.45% 3.20% 2.96% |

3.75% 3.75% 3.75% 3.50% 3.60% 3.50% 3.25% 3.00% |

| Regular Certificate 6 Month 12 Month 15 Month 18 Month 24 Month 36 Month 48 Month 60 Month |

$75,000.00 $75,000.00 $75,000.00 $75,000.00 $75,000.00 $75,000.00 $75,000.00 $75,000.00 |

3.78% 3.78% 3.78% 3.54% 3.54% 3.54% 3.30% 3.06% |

3.85% 3.85% 3.85% 3.60% 3.60% 3.60% 3.35% 3.10% |

| Youth Certificate 6 Month 12 Month 24 Month |

$500.00 $500.00 $500.00 |

3.69% 3.69% 3.45% |

3.75% 3.75% 3.50% |

Dividends will be compounded and credited quarterly. If you close your share account before dividends are paid, you will not receive the accrued dividends.

After your certificate is opened, the dividend rate is fixed for the term.

Certificates may have a penalty imposed for early withdrawal.

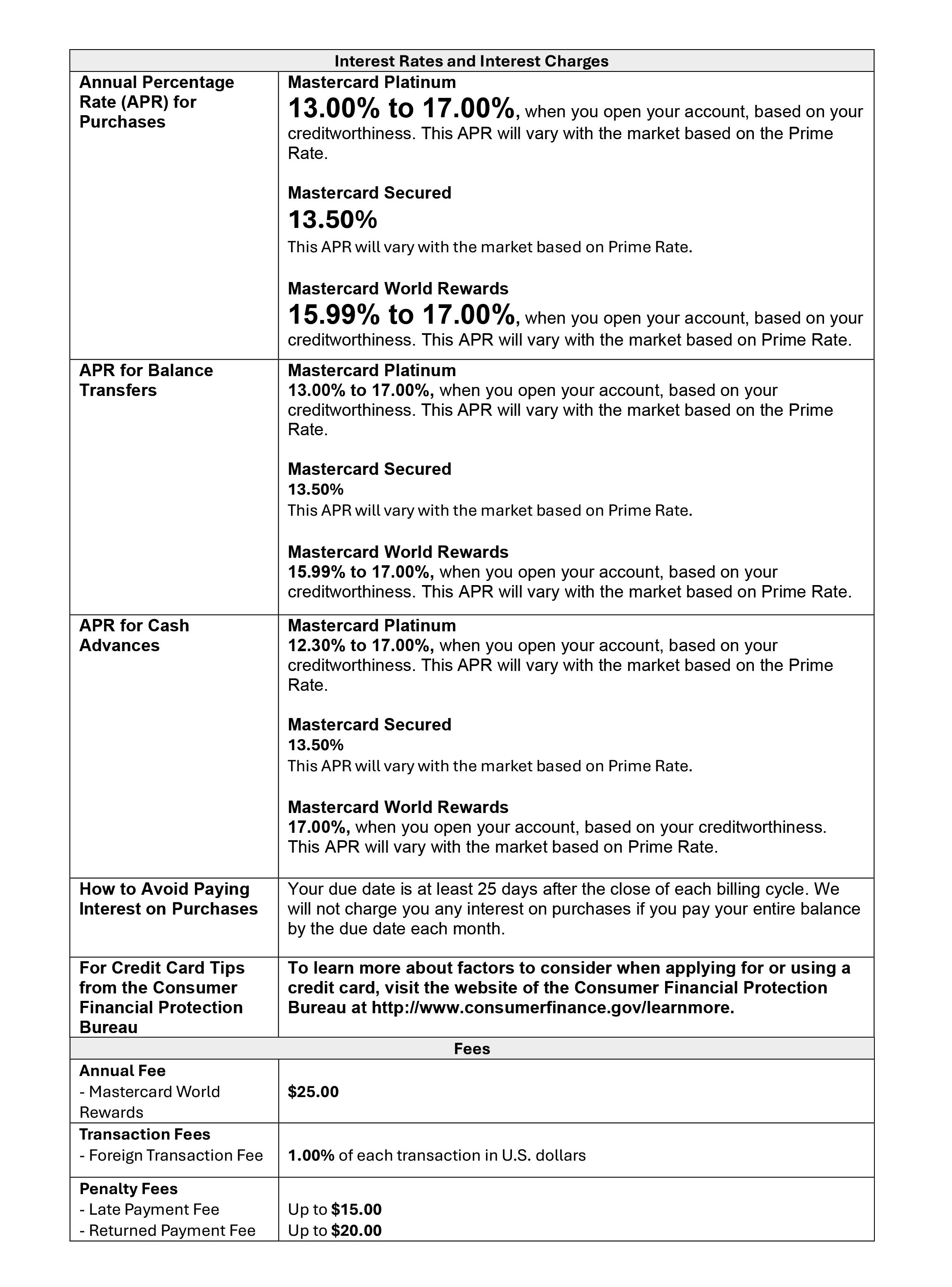

Credit Cards

| Loan Type | APR |

|---|---|

| MasterCard Rewards Card $25 Annual Fee, 25 Day Grace Period |

As low as 15.99% |

| MasterCard Platinum Card No Annual Fee, 25 Day Grace Period |

As low as 13.00% |

| Cash Secured Card No Annual Fee, 25 Day Grace Period |

As low as 13.50% |

*Rates may vary

Deposit Accounts

| Account Type | Minimum Opening Deposit | Minimum Balance to Earn | Dividend Rate | APY |

|---|---|---|---|---|

| Prime Checking $1,000.00 |

$25.00 |

$1000.00 |

0.20% |

0.20% |

Home Loans

Please contact Ladana Inkman for an interest rate quote: 469-774-2020 or email: [email protected]

IRA Certificates

| Term | Minimum Balance | Dividend Rate | APY |

|---|---|---|---|

| 6 Month 12 Month 24 Month 36 Month 48 Month 60 Month |

$1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 |

3.69% 3.69% 3.45% 3.45% 3.20% 2.96% |

3.75% 3.75% 3.50% 3.50% 3.25% 3.00% |

| IRA Certificate 6 Month 12 Month 24 Month 36 Month 48 Month 60 Month |

$75,000.00 $75,000.00 $75,000.00 $75,000.00 $75,000.00 $75,000.00 |

3.78% 3.78% 3.54% 3.54% 3.30% 3.06% |

3.85% 3.85% 3.60% 3.60% 3.35% 3.10% |

Dividends will be compounded and credited quarterly. If you close your share account before dividends are paid, you will not receive the accrued dividends.

After your certificate is opened, the dividend rate is fixed for the term.

Certificates may have a penalty imposed for early withdrawal.

Kasasa Cash*

| Balance | Rate | APY |

|---|---|---|

| $0 - $25,000 | 4.89% | 5.00% |

| $25,000.01+ | 0.76% | 5.00% to 0.76% |

| All balances if qualifications not met | 0.06% | 0.06% |

Minimum deposit of $25.00 required to open Kasasa Cash account.

Qualifications

To earn your rewards, just do the following transactions and activities in your Kasasa Cash account during each Monthly Qualification Cycle:

- Have at least 1 direct deposit or ACH payment transaction post and settle

- Have at least 12 debit card purchases post and settle

- Be enrolled in and agree to receive eStatements

- Enroll and log into online banking

Kasasa Saver*

| Balance | Rate | APY |

|---|---|---|

| $0 - $25,000 | 0.85% | 0.85% |

| $25,000.01+ | 0.75% | 0.85% to 0.75% |

| All balances if qualifications not met | 0.06% | 0.06% |

Qualifications

To earn your rewards, just do the following transactions and activities in your Kasasa account during each Monthly Qualification Cycle:

- Have at least 1 direct deposit or ACH payment transaction post and settle

- Have at least 12 debit card purchases post and settle

- Be enrolled in and agree to receive eStatements

- Enroll and log into online banking

Personal Loans

| Loan Type | APR |

|---|---|

| Unsecured Loans | As low as 12.74% |

Collateral subject to approval. Rates based on creditworthiness.

Recreational Vehicles

| Loan Type | 36 Month APR | 60 Month APR | 72 Month APR |

|---|---|---|---|

| New (2026 - 2025) | 8.75% | 9.25% | 10.25% |

| Used (2026 and older) | 10.25% | 10.70% | 11.00% |

Collateral subject to approval. Rates based on creditworthiness.

Savings Accounts

| Account Type | Minimum Opening Deposit | Minimum Balance to Earn | Dividend Rate | APY |

|---|---|---|---|---|

| Savings Account $0-25,000 $25,000.01 & over |

$5.00 |

$5.00 |

0.10% 0.10% |

0.10% 0.10% |

| Christmas Club $0-25,000 $25,000.01 & over |

- - |

- - |

0.50% 0.50% |

0.50% 0.50% |

| IRA Savings $0-25,000 $25,000.01 & over |

- - |

- - |

0.10% 0.10% |

0.10% 0.10% |

| Money Market $0-25,000 $25,000.01 & over |

$2,500.00 |

$2,500.00 |

0.15% 0.20% |

0.15% 0.20% |

Dividends will be compounded and will be credited monthly. Average Daily Balance.