No more waiting

Instant payment options let you skip the waiting period and experiences updates in real time.

Benefits You'll Love

- Send payments securely

- Receive payments within seconds

- Enjoy 24/7 funds transfer options

- Conveniently set up instant payments with one brief call

Effective December 18th, 2023, My Community Credit Union is a participating financial institution in the FedNow Instant Payment service allowing our members to receive instant credit payments.

What is FedNow?

FedNow is a 24x7x365 instant payments transfer service offered through the Federal Reserve Bank that enables participating U.S. banks and credit unions to transfer funds within seconds.

Funds received from an instant payment will typically1 update your current available account balance immediately. Instant payments received will post to your account with the description “Instant Pay from…sender name”.

Who can send an instant payment?

The sender who originates an instant payment must have an account with a financial institution that has send capabilities2.

How can I receive an instant payment credit?

Members can receive Instant Payment credits to their saving, checking and loan accounts3 by providing their 14-digit account number and MCCU’s Routing Number to the sender.

To locate your 14-digit account number, login to Online Banking. Locate the 14-digit number to the side or underneath the account type you wish to receive the Instant Payment.

MCCU Routing Number: 316386434

If you do not have an Online Banking account, please speak with an FSR at one of our branch locations or call the number below to get you set up today!

Phone: 432-688-8400

Toll Free: 888-909-MYCU

To learn more about the FedNow Service, please visit explore.fednow.org.

1Instant payments generally occur within seconds. Certain circumstances could result in a delay or prevent an instant payment from completing. If you are expecting an instant payment and it has not posted, please contact an MCCU representative.

2MCCU currently does not offer send capabilities to its membership.

3Mortgage and Credit Card loans currently cannot accept an instant payment. Contact an MCCU representative to get more information on making a payment to these loan types.

Use this calculator to determine your projected earnings from our Kasasa Cash account. Move the sliders or type in the numbers to see your potential rewards.

- Estimated Annual Rewards $0

- Estimated monthly dividends earned* $0

- Monthly ATM fees refunded**$0

This calculator compares the costs of buying or leasing a vehicle. There are three sections to complete, and you can adjust and experiment with different scenarios.

- Net cost of buying $0

- Net cost of leasing $0

A fixed-rate, fixed-term CD can earn higher returns than a standard savings account. Use this calculator to get an estimate of your earnings. Move the sliders or type in numbers to get started.

- Total value at maturity $0

- Total dividends earned $0

- Annual Percentage Yield (APY)0.000%

Whether it's a down payment, college, a dream vacation...a savings plan can help you reach your goal. Use the sliders to experiment based on length of time and amount per month.

- Monthly deposit needed to reach goal $0

This calculator can help you get a general idea of monthly payments to expect for a simple loan. Move the sliders or type in numbers to get started.

- Estimated monthly payment $0

- Total paid $0

- Total interest paid $0

Auto & Motorcycle Loans

| Loan Type | 36 Month APR | 60 Month APR | 72 Month APR |

|---|---|---|---|

| New (2026 - 2025) | 5.24% | 5.49% | 5.74% |

| Used (2026 - 2022) | 5.49% | 5.74% | 5.99% |

| Used (2021 - 2020) | 6.04% | 6.04% | 7.24% |

| Used (2019 and older) | 7.09% | 7.64% | N/A |

Collateral subject to approval. Rates based on creditworthiness.

For motorcycles, add 1.00% to the base auto loan rate.

Payment Example: New auto loan of $20,000 for 60 months at 5.24% APR will have a monthly payment of $380.

Payment Example: New auto loan of $30,000 for 72 months at 5.49% APR will have a monthly payment of $490

Cash Secured Loans

| Loan Type | APR |

|---|---|

| Savings Secured Loan | 3.30% above pledged shares |

| Certificate (CD) Secured Loan | 2.30% above pledged certificate |

CD/Share Certificates

| Term | Minimum Balance | Dividend Rate | APY |

|---|---|---|---|

| 6 Month 12 Month 15 Month 18 Month 24 Month 36 Month 48 Month 60 Month |

$1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 |

3.69% 3.69% 3.69% 3.45% 3.54% 3.45% 3.20% 2.96% |

3.75% 3.75% 3.75% 3.50% 3.60% 3.50% 3.25% 3.00% |

| Regular Certificate 6 Month 12 Month 15 Month 18 Month 24 Month 36 Month 48 Month 60 Month |

$75,000.00 $75,000.00 $75,000.00 $75,000.00 $75,000.00 $75,000.00 $75,000.00 $75,000.00 |

3.78% 3.78% 3.78% 3.54% 3.54% 3.54% 3.30% 3.06% |

3.85% 3.85% 3.85% 3.60% 3.60% 3.60% 3.35% 3.10% |

| Youth Certificate 6 Month 12 Month 24 Month |

$500.00 $500.00 $500.00 |

3.69% 3.69% 3.45% |

3.75% 3.75% 3.50% |

Dividends will be compounded and credited quarterly. If you close your share account before dividends are paid, you will not receive the accrued dividends.

After your certificate is opened, the dividend rate is fixed for the term.

Certificates may have a penalty imposed for early withdrawal.

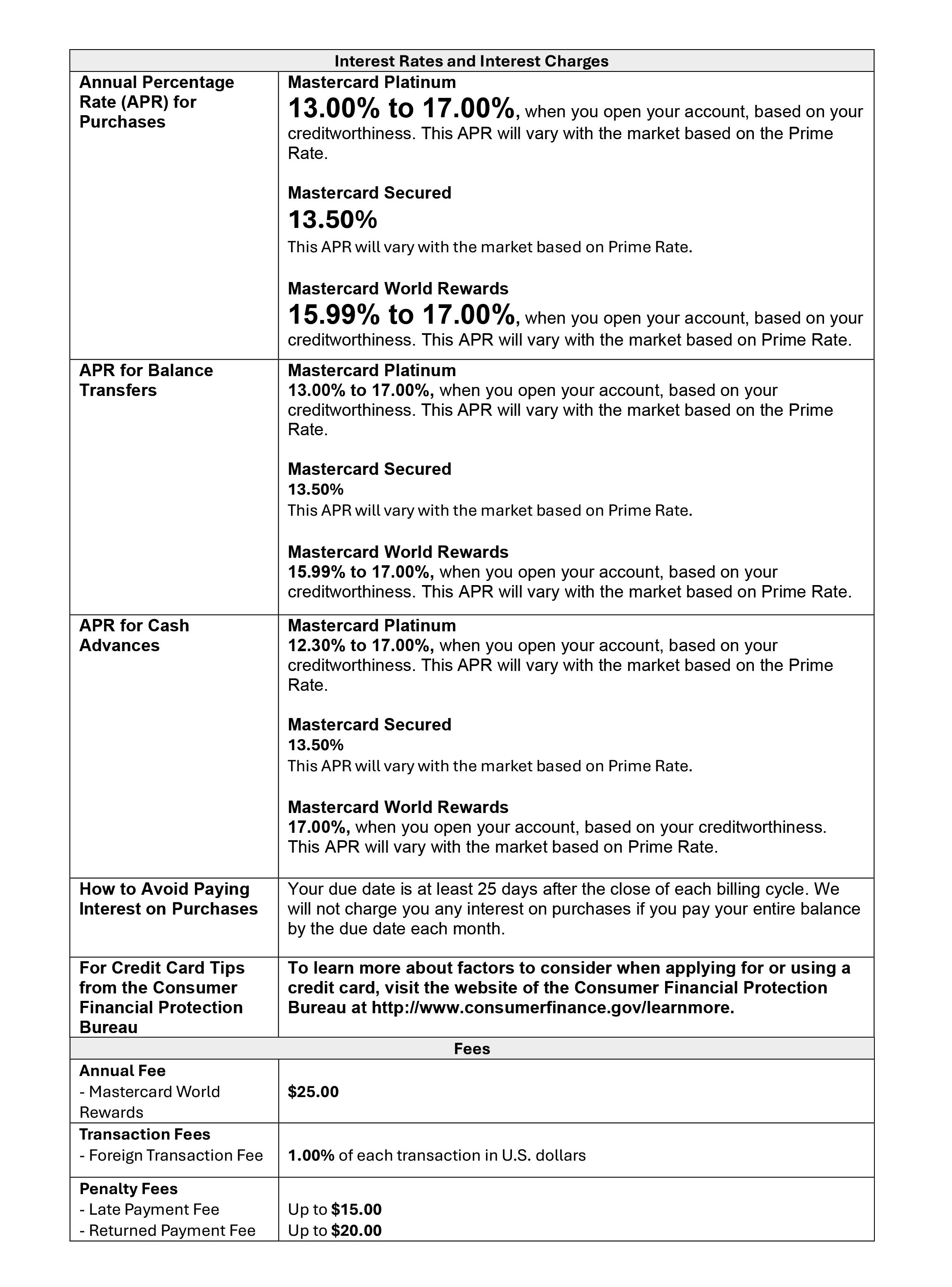

Credit Cards

| Loan Type | APR |

|---|---|

| MasterCard Rewards Card $25 Annual Fee, 25 Day Grace Period |

As low as 15.99% |

| MasterCard Platinum Card No Annual Fee, 25 Day Grace Period |

As low as 13.00% |

| Cash Secured Card No Annual Fee, 25 Day Grace Period |

As low as 13.50% |

*Rates may vary

Deposit Accounts

| Account Type | Minimum Opening Deposit | Minimum Balance to Earn | Dividend Rate | APY |

|---|---|---|---|---|

| Prime Checking $1,000.00 |

$25.00 |

$1000.00 |

0.20% |

0.20% |

Home Loans

Please contact Ladana Inkman for an interest rate quote: 469-774-2020 or email: [email protected]

IRA Certificates

| Term | Minimum Balance | Dividend Rate | APY |

|---|---|---|---|

| 6 Month 12 Month 24 Month 36 Month 48 Month 60 Month |

$1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 |

3.69% 3.69% 3.45% 3.45% 3.20% 2.96% |

3.75% 3.75% 3.50% 3.50% 3.25% 3.00% |

| IRA Certificate 6 Month 12 Month 24 Month 36 Month 48 Month 60 Month |

$75,000.00 $75,000.00 $75,000.00 $75,000.00 $75,000.00 $75,000.00 |

3.78% 3.78% 3.54% 3.54% 3.30% 3.06% |

3.85% 3.85% 3.60% 3.60% 3.35% 3.10% |

Dividends will be compounded and credited quarterly. If you close your share account before dividends are paid, you will not receive the accrued dividends.

After your certificate is opened, the dividend rate is fixed for the term.

Certificates may have a penalty imposed for early withdrawal.

Kasasa Cash*

| Balance | Rate | APY |

|---|---|---|

| $0 - $25,000 | 4.89% | 5.00% |

| $25,000.01+ | 0.76% | 5.00% to 0.76% |

| All balances if qualifications not met | 0.06% | 0.06% |

Minimum deposit of $25.00 required to open Kasasa Cash account.

Qualifications

To earn your rewards, just do the following transactions and activities in your Kasasa Cash account during each Monthly Qualification Cycle:

- Have at least 1 direct deposit or ACH payment transaction post and settle

- Have at least 12 debit card purchases post and settle

- Be enrolled in and agree to receive eStatements

- Enroll and log into online banking

Kasasa Saver*

| Balance | Rate | APY |

|---|---|---|

| $0 - $25,000 | 0.85% | 0.85% |

| $25,000.01+ | 0.75% | 0.85% to 0.75% |

| All balances if qualifications not met | 0.06% | 0.06% |

Qualifications

To earn your rewards, just do the following transactions and activities in your Kasasa account during each Monthly Qualification Cycle:

- Have at least 1 direct deposit or ACH payment transaction post and settle

- Have at least 12 debit card purchases post and settle

- Be enrolled in and agree to receive eStatements

- Enroll and log into online banking

Personal Loans

| Loan Type | APR |

|---|---|

| Unsecured Loans | As low as 12.74% |

Collateral subject to approval. Rates based on creditworthiness.

Recreational Vehicles

| Loan Type | 36 Month APR | 60 Month APR | 72 Month APR |

|---|---|---|---|

| New (2026 - 2025) | 8.75% | 9.25% | 10.25% |

| Used (2026 and older) | 10.25% | 10.70% | 11.00% |

Collateral subject to approval. Rates based on creditworthiness.

Savings Accounts

| Account Type | Minimum Opening Deposit | Minimum Balance to Earn | Dividend Rate | APY |

|---|---|---|---|---|

| Savings Account $0-25,000 $25,000.01 & over |

$5.00 |

$5.00 |

0.10% 0.10% |

0.10% 0.10% |

| Christmas Club $0-25,000 $25,000.01 & over |

- - |

- - |

0.50% 0.50% |

0.50% 0.50% |

| IRA Savings $0-25,000 $25,000.01 & over |

- - |

- - |

0.10% 0.10% |

0.10% 0.10% |

| Money Market $0-25,000 $25,000.01 & over |

$2,500.00 |

$2,500.00 |

0.15% 0.20% |

0.15% 0.20% |

Dividends will be compounded and will be credited monthly. Average Daily Balance.