Protect the things you've worked so hard for

We offer a variety of ways to protect your investments - and the loans that make them possible.

Benefits You'll Love

- Peace of mind coverage

- Affordable pricing options

- Prepare for the unexpected

- Lean on My Community when you need it

Will your Insurance Cover Your Auto Loan in the Event of a Total Loss or Theft?

Probably not. In fact, if the average new car owner has their vehicle stolen or damaged beyond repair, they could still owe thousands of dollars after the insurance settlement.

GAP Advantage can pay up to the remaining balance of your auto loan after an insurance payout, protecting you from a financial loss.

GAP Advantage makes up the difference between what your insurance policy covers and the amount you still owe—in most cases. So, instead of paying off a substantial loan balance for a vehicle you can no longer drive, you could be free and clear of your car note. Plus, GAP Advantage will provide a set allowance towards financing a replacement vehicle with us, getting you back on the road!

With this valuable product, you can rest easy knowing that your auto loan won’t be a burden if an unexpected accident or theft occurs.

Your purchase of GAP Advantage is optional. Whether or not you purchase GAP Advantage will not affect your application for credit or the terms of any existing credit agreement you have with the financial institution. There are eligibility requirements, conditions, and exclusions that could prevent you from receiving benefits under GAP Advantage. You should carefully read the contract for a full explanation.

With MMP, You Can Get the Most Out of Your Mileage!

As time goes on, the likelihood of mechanical failure on your vehicle is inevitable. Advanced electronics, complex systems, and rising labor costs mean that a repair that might have cost hundreds of dollars a few years ago may now cost you thousands.

With Major Mechanical Protection (MMP) from My Community, you can protect yourself against the expense of future costly repairs.

The total cost of MMP is often far less than the cost of a single repair! Pay for this protection once, and in most cases you will not have to pay anything more than a small deductible should a breakdown occur.

To learn more about MMP, call your service representative today at 432-688-8400!

Even the most responsible person can be hit with bills they can’t pay, damage to their credit score, and even repossessions when unexpected illness, injury, or death eliminates their ability to earn a paycheck.

When you add Payment Protection to your loan1 or other obligations, you minimize the impact of the unexpected. In most cases, Payment Protection can:

- Eliminate all or part of your remaining loan balance

- Protect your credit rating as loan payment obligations are made on your behalf

- Prevent late fees

- Protect your family and your possessions

- Free-up extra cash when it’s needed most

- Pay benefits in addition to any other protection you may have

Payment Protection is affordable, may cover both you and your co-borrower, and is a part of your regular payment—giving you one less thing to think about.

To learn more about Payment Protection, contact your service representative today at 432-688-8400!

1Payment Protection may be available for personal credit cards, auto loans, personal consumer loans, and home equity loans.

Your purchase of Payment Protection is optional. Whether or not you purchase Payment Protection will not affect your application for credit or the terms of any existing credit agreement you have with the financial institution. There are eligibility requirements, conditions, and exclusions that could prevent you from receiving benefits under Payment Protection. You should carefully read the contract for a full explanation of the terms.

Be Prepared for Costly Vehicle Repairs

Protecting your vehicle from costly repairs has never been easier thanks to a protection plan from healthCAR. This first-of-its-kind plan provides affordable, month-to-month coverage that you can enroll in completely online!

Coverage benefits:

- Straight-forward affordable pricing

- Affordable monthly payments

- No long-term contracts; you can cancel anytime with written notice

- Easy, online enrollment

- Coverage for vehicles up to 20 years old

- Unlimited mileage protection

- If your vehicle experiences a covered breakdown, you only pay a $100 deductible

- Roadside Assistance that extends to your dependents

Visit, https://myhealthcar.com/company/my-community-credit-union/ to enroll today!

Use this calculator to determine your projected earnings from our Kasasa Cash account. Move the sliders or type in the numbers to see your potential rewards.

- Estimated Annual Rewards $0

- Estimated monthly dividends earned* $0

- Monthly ATM fees refunded**$0

This calculator compares the costs of buying or leasing a vehicle. There are three sections to complete, and you can adjust and experiment with different scenarios.

- Net cost of buying $0

- Net cost of leasing $0

A fixed-rate, fixed-term CD can earn higher returns than a standard savings account. Use this calculator to get an estimate of your earnings. Move the sliders or type in numbers to get started.

- Total value at maturity $0

- Total dividends earned $0

- Annual Percentage Yield (APY)0.000%

Whether it's a down payment, college, a dream vacation...a savings plan can help you reach your goal. Use the sliders to experiment based on length of time and amount per month.

- Monthly deposit needed to reach goal $0

This calculator can help you get a general idea of monthly payments to expect for a simple loan. Move the sliders or type in numbers to get started.

- Estimated monthly payment $0

- Total paid $0

- Total interest paid $0

Auto & Motorcycle Loans

| Loan Type | 36 Month APR | 60 Month APR | 72 Month APR |

|---|---|---|---|

| New (2025 - 2024) | 4.99% | 5.49% | 5.74% |

| Used (2025 - 2021) | 5.24% | 5.74% | 5.99% |

| Used (2020 - 2019) | 5.79% | 6.04% | 7.24% |

| Used (2018 and older) | 6.84% | 7.64% | N/A |

Rates include discount for automatic payment. Collateral subject to approval. Rates based on creditworthiness.

For motorcycles, add 1.00% to the base auto loan rate.

Payment Example: New auto loan of $20,000 for 60 months at 5.24% APR will have a monthly payment of $380.

Payment Example: New auto loan of $30,000 for 72 months at 5.49% APR will have a monthly payment of $490

Cash Secured Loans

| Loan Type | APR |

|---|---|

| Savings Secured Loan | 3.30% above pledged shares |

| Certificate (CD) Secured Loan | 2.30% above pledged certificate |

CD/Share Certificates

| Term | Minimum Balance | Dividend Rate | APY |

|---|---|---|---|

| 6 Month 12 Month 15 Month 18 Month 24 Month 36 Month 48 Month 60 Month |

$1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 |

3.69% 3.69% 3.69% 3.69% 3.54% 3.45% 3.20% 2.96% |

3.75% 3.75% 3.75% 3.75% 3.60% 3.50% 3.25% 3.00% |

| Regular Certificate 6 Month 12 Month 15 Month 18 Month 24 Month 36 Month 48 Month 60 Month |

$75,000.00 $75,000.00 $75,000.00 $75,000.00 $75,000.00 $75,000.00 $75,000.00 $75,000.00 |

3.78% 3.78% 3.78% 3.78% 3.64% 3.54% 3.30% 3.06% |

3.85% 3.85% 3.85% 3.85% 3.70% 3.60% 3.35% 3.10% |

| Youth Certificate 6 Month 12 Month 24 Month |

$500.00 $500.00 $500.00 |

3.69% 3.69% 3.54% |

3.75% 3.75% 3.60% |

Dividends will be compounded and credited quarterly. If you close your share account before dividends are paid, you will not receive the accrued dividends.

After your certificate is opened, the dividend rate is fixed for the term.

Certificates may have a penalty imposed for early withdrawal.

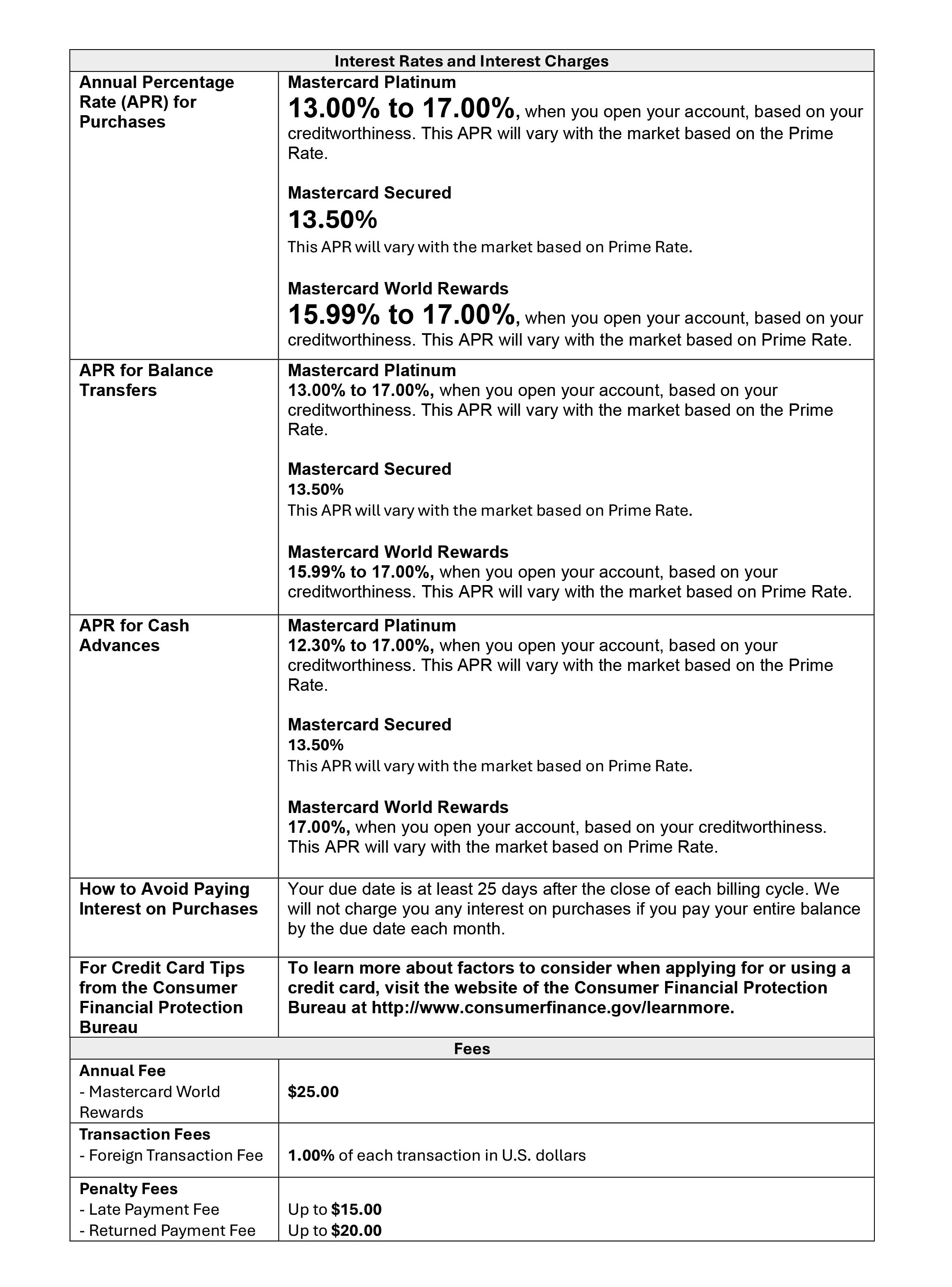

Credit Cards

| Loan Type | APR |

|---|---|

| MasterCard Rewards Card $25 Annual Fee, 25 Day Grace Period |

As low as 15.99% |

| MasterCard Platinum Card No Annual Fee, 25 Day Grace Period |

As low as 13.00% |

| Cash Secured Card No Annual Fee, 25 Day Grace Period |

As low as 13.50% |

*Rates may vary

Deposit Accounts

| Account Type | Minimum Opening Deposit | Minimum Balance to Earn | Dividend Rate | APY |

|---|---|---|---|---|

| Prime Checking $1,000.00 |

$25.00 |

$1000.00 |

0.20% |

0.20% |

Home Loans

Please contact Ladana Inkman for an interest rate quote: 469-774-2020 or email: [email protected]

IRA Certificates

| Term | Minimum Balance | Dividend Rate | APY |

|---|---|---|---|

| 6 Month 12 Month 24 Month 36 Month 48 Month 60 Month |

$1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 |

3.69% 3.69% 3.54% 3.45% 3.20% 2.96% |

3.75% 3.75% 3.60% 3.50% 3.25% 3.00% |

| IRA Certificate 6 Month 12 Month 24 Month 36 Month 48 Month 60 Month |

$75,000.00 $75,000.00 $75,000.00 $75,000.00 $75,000.00 $75,000.00 |

3.78% 3.78% 3.64% 3.54% 3.30% 3.06% |

3.85% 3.85% 3.70% 3.60% 3.35% 3.10% |

Dividends will be compounded and credited quarterly. If you close your share account before dividends are paid, you will not receive the accrued dividends.

After your certificate is opened, the dividend rate is fixed for the term.

Certificates may have a penalty imposed for early withdrawal.

Kasasa Cash*

| Balance | Rate | APY |

|---|---|---|

| $0 - $25,000 | 4.89% | 5.00% |

| $25,000.01+ | 0.76% | 5.00% to 0.76% |

| All balances if qualifications not met | 0.06% | 0.06% |

Minimum deposit of $25.00 required to open Kasasa Cash account.

Qualifications

To earn your rewards, just do the following transactions and activities in your Kasasa Cash account during each Monthly Qualification Cycle:

- Have at least 1 direct deposit or ACH payment transaction post and settle

- Have at least 12 debit card purchases post and settle

- Be enrolled in and agree to receive eStatements

- Enroll and log into online banking

Kasasa Saver*

| Balance | Rate | APY |

|---|---|---|

| $0 - $25,000 | 0.85% | 0.85% |

| $25,000.01+ | 0.75% | 0.85% to 0.75% |

| All balances if qualifications not met | 0.06% | 0.06% |

Qualifications

To earn your rewards, just do the following transactions and activities in your Kasasa account during each Monthly Qualification Cycle:

- Have at least 1 direct deposit or ACH payment transaction post and settle

- Have at least 12 debit card purchases post and settle

- Be enrolled in and agree to receive eStatements

- Enroll and log into online banking

Personal Loans

| Loan Type | APR |

|---|---|

| Unsecured Loans | As low as 12.49% |

Rates include discount for automatic payment. Collateral subject to approval. Rates based on creditworthiness.

Recreational Vehicles

| Loan Type | 36 Month APR | 60 Month APR | 72 Month APR |

|---|---|---|---|

| New (2025 - 2024) | 8.50% | 9.00% | 10.00% |

| Used (2025 and older) | 10.00% | 10.45% | 10.75% |

Rates include discount for automatic payment. Collateral subject to approval. Rates based on creditworthiness.

Savings Accounts

| Account Type | Minimum Opening Deposit | Minimum Balance to Earn | Dividend Rate | APY |

|---|---|---|---|---|

| Savings Account $0-25,000 $25,000.01 & over |

$5.00 |

$5.00 |

0.10% 0.10% |

0.10% 0.10% |

| Christmas Club $0-25,000 $25,000.01 & over |

- - |

- - |

0.50% 0.50% |

0.50% 0.50% |

| IRA Savings $0-25,000 $25,000.01 & over |

- - |

- - |

0.10% 0.10% |

0.10% 0.10% |

| Money Market $0-25,000 $25,000.01 & over |

$2,500.00 |

$2,500.00 |

0.15% 0.20% |

0.15% 0.20% |

Dividends will be compounded and will be credited monthly. Average Daily Balance.